There is good news for veterans and active duty servicemembers concerned about future education expenses. Both military and civilian programs exist to help. Here’s a brief introduction to four potential opportunities.

Post-9/11 GI Bill

The Post-9/11 GI Bill is an education benefit program available to those who served on active duty after September 10, 2001. It typically covers up to 36 months of tuition and fees. Allowances are also available for housing, books, and supplies.

The benefit pays 100 percent of tuition and fees for in-state students at public schools. It can be used at domestic and some overseas institutions. The cap for private and foreign schools is approximately $26,000 per academic year.

Benefits may be transferred to a spouse or child. But the transfer application must be made while still on active duty. The servicemember must agree to additional service to make the transfer.

Yellow Ribbon Program

The Yellow Ribbon Program can pay expenses above what the Post-9/11 GI Bill can cover. It has additional eligibility requirements. In addition to qualifying for the Post-9/11 GI Bill, one of the following must apply to the applicant:

1) Have served at least 36 months on active duty and were honorably discharged, or

2) Received a Purple Heart on or after September 11, 2001, and were honorably discharged after any length of service, or

3) Served at least 30 continuous days on or after September 11, 2001, and were discharged or released from active duty because of a service-connected disability, or

4) Are a dependent child using transferred benefits, or

5) Are a Fry Scholarship recipient

Program Limitations

The Yellow Ribbon Program’s benefits can be used only at schools approved by the VA.

Both programs have set annual benefit limits. Once they are exhausted, they are gone forever. And transferred benefits must be used within a limited amount of time.

The good news is that there are civilian education savings plans that can complement the Post-9/11 GI Bill and the Yellow Ribbon Program.

Coverdell Education Savings Account

Investment earnings in a Coverdell Educations Savings Account (ESA) are not taxed by the federal government.[i] And there is no federal income tax liability when funds are withdrawn to pay qualified education expenses.

An ESA can never receive more than $2,000 in annual contributions, which are not tax deductible. Allowable contributions get reduced (ultimately to zero) based on the income of the person making them.

Anyone can contribute to an ESA as long as the beneficiary is 18 or younger.[ii] Funds remaining in an ESA after age 18 belong to the beneficiary. But if they aren’t used for qualified education expenses, withdrawals become taxable income and subject to a penalty.

529 Plan Account

Like an ESA, earnings in a 529 plan account aren’t subject to federal income tax. Also, withdrawals used to pay qualified education expenses don’t create federal taxable income. And contributions aren’t deductible. [iii]

A 529 plan account can be opened by anyone for anyone. The beneficiary’s age doesn’t matter. A 529 plan account can be opened for adult children, a spouse, or oneself. Beneficiaries can change. So, an account could fund more than one person’s education. [iv]

Unlike an ESA, there is no federal restriction on annual contributions.[v] Some states impose limits. But they are typically tens of thousands of dollars. Lifetime contribution limits are over $500,000 in some states. And the person who establishes a 529 plan account controls it.

Funds can be used to pay K through 12 tuition and fees, any expense required by a college or trade school to enroll or attend, some room and board, or up to $10,000 in student loan debt.

There are two types of 529 plan accounts. One lets you prepay tuition at specific institutions in a given state. The other lets you save money that can be used at almost any type of school (e.g., public, private, in-state, out-of-state, international, professional, vocational).

Choosing the Right Education Funding Program

These are just a few of the programs available to help servicemembers and veterans pay for education. Each has its own eligibility requirements, funding features, and payment benefits.

It should be noted that only active duty servicemembers and veterans can take advantage of the military opportunities (Post-9/11 GI Bill, Yellow Ribbon Program). But that doesn’t mean they are excluded from using the civilian programs (ESA, 529).

That’s why planning is so important. Planning can help fit all the pieces together so that the combination of military and civilian programs is personalized and optimized for a given situation.

Click here to see how these programs compare to one another.

[i] NOTE: Not all states follow federal tax rules. So, earnings could be taxed at the state level.

[ii] Contributions are not allowed after age 18 unless the beneficiary is a special needs beneficiary.

[iii] Residents in some states may be able to deduct contributions on a state tax return.

[iv] By naming successive beneficiaries.

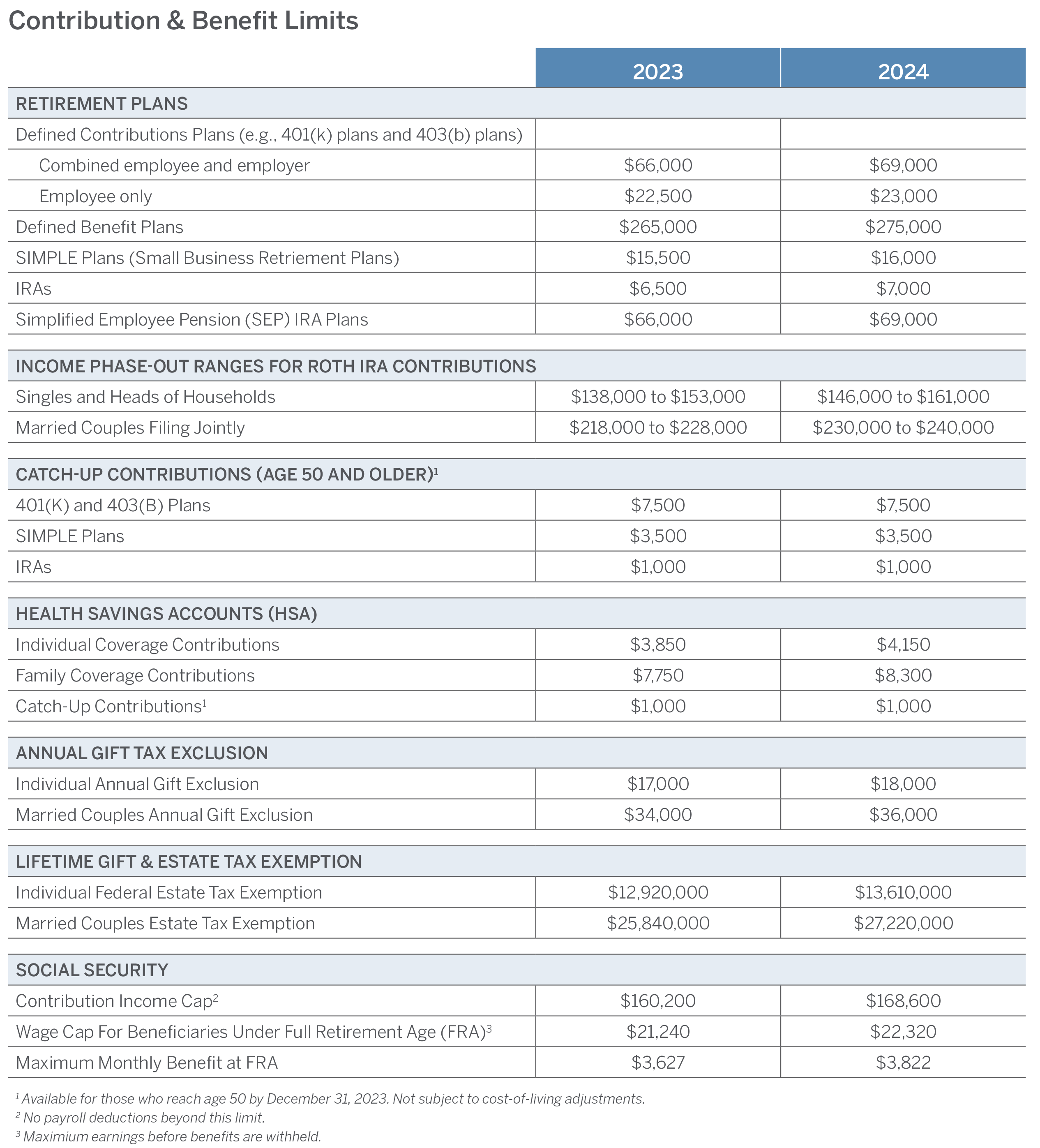

[v] Contributions over the Federal Gift Tax Exclusion are subject to tax.

[vi] Must be part of the federal student aid program.

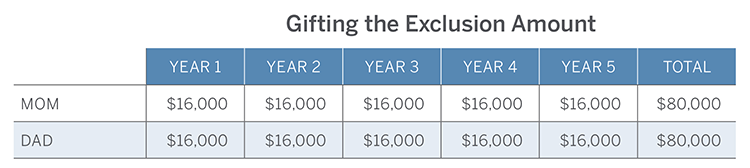

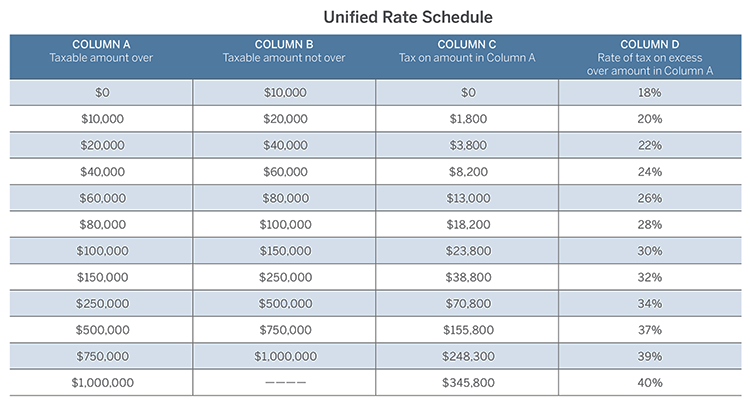

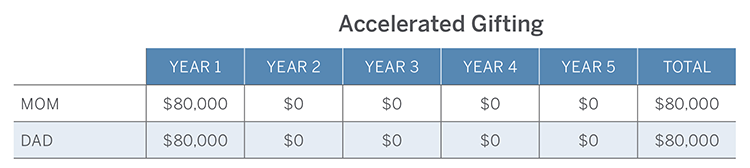

The math would be the same if the couple had 10 children. Only the magnitude of the numbers would change. It would be $320,000 in this case. And it’s important to note that gifts can be made to anyone, not just the couple’s children.

The math would be the same if the couple had 10 children. Only the magnitude of the numbers would change. It would be $320,000 in this case. And it’s important to note that gifts can be made to anyone, not just the couple’s children.

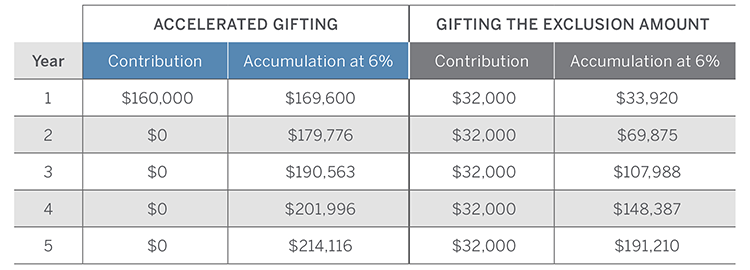

The benefit of this front-end loading may not be apparent upon first glance. After all, the total noted in the illustration above is exactly that of the illustration below.

The benefit of this front-end loading may not be apparent upon first glance. After all, the total noted in the illustration above is exactly that of the illustration below.