Equities: Strengthen your core

Christopher Cuesta, CFA, Manish Maheshwari, CFA 12-Aug-2022

No pain, No gain. Is that a fitness mantra, or something investors have been mumbling these days? After all, the first half of 2022 has seen most major stock averages—including the widely followed Russell 2000 Index that’s a barometer for small-cap stocks—fall precipitously.

Stocks snapped back in July to some degree, but it’s been a tough year overall. Nevertheless, we continue to believe that investors should remain committed to diversifying across the capitalization spectrum. And when it comes to small-cap stocks, an approach focused on the “core” style box might be a smarter way to allocate given the mercurial nature of investor sentiment and the macro environment.

A core approach can mean different things to different managers, but in general it’s focused somewhere in the middle between traditional growth and value styles. But in order to avoid artificial index constraints, we also believe any small-cap core strategy should also maintain some flexibility to invest in companies across segments of either the growth or value spectrum.

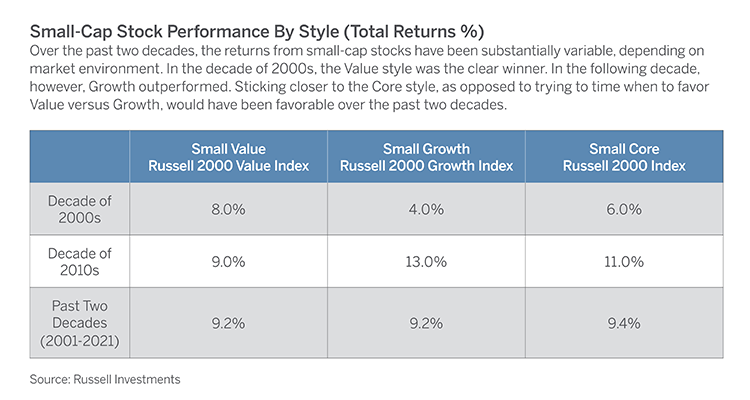

There is, however, an important distinction to be made. We believe that a key tenet of core investing is skewing toward high-quality profitable companies, thereby avoiding speculative securities with high tail risk (i.e. the chance of a significant loss occurring due to a rare event, often during periods of financial stress). This might mean sacrificing some growth potential in times of irrational exuberance when story stocks and speculative companies tend to lead the market, but it seems like a fair trade for prudent risk management purposes. It also would seem to set up a portfolio with greater potential for consistent returns irrespective of market environment. The long-term data illustrates how a small-cap core approach has been generally able to provide stabilized returns across a variety of macro backdrops. Consider the data over the longer term, which is displayed in the below table:

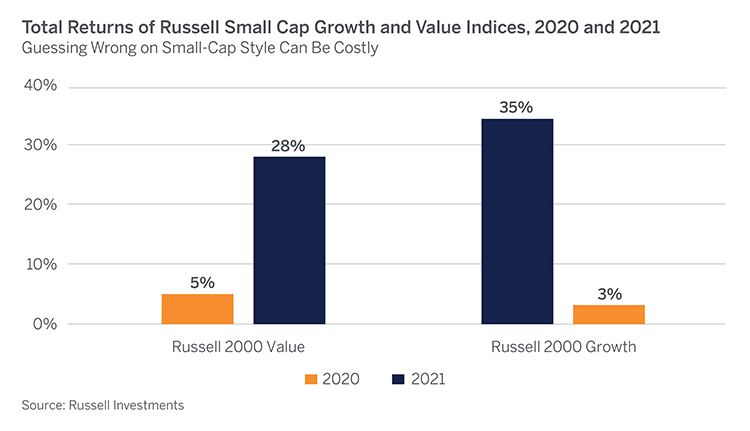

Drilling down to the unusual market dynamics of the past several years further demonstrates why we prefer our active approach that sticks closer to the Core. Ever since the pandemic, we’ve witnessed a major bifurcation of the small cap market that has whipsawed investors. The market has become quite stylized and rotations between small growth and small value have been abrupt. For a spell after the pandemic, aggressive growth stocks were in-vogue, buoyed not only by promising technologies, but also by extremely low borrowing costs, ample liquidity and—let’s face it—unbridled enthusiasm. But almost just as quickly when it was clear that a new rate-hike cycle was approaching, investors lost their taste for small, speculative stocks in favor of companies with more solid balance sheets and real earnings. The below graph shows the markedly different performance of the small cap styles over the past two years.

Rather, than chasing trends based on interest rate forecasts or other dubious macro predictions, we believe that investing in profitable small-cap companies that can finance growth through internally generated cash flows rather than at the expense of shareholders (i.e. dilution or too much leverage) offers the best path to consistent returns. Typically, we see most of these companies hovering near the middle style box—the core. And by employing an active approach we can avoid both sector concentrations of certain indices while maintaining the flexibility to invest in quality companies that might otherwise fall under either growth or value style monikers. We think that’s particularly important for today’s small-cap investors, and that’s why we keep focused on the core.