Equities: Fussing over free cash flow

Michael Mack 18-Aug-2023

In the pre-2022 environment of zero-bound interest rates, ample fiscal stimulus, and two percent (or less) inflation, investors didn’t seem to pay much heed to free cash flow. After all, capital was cheap, businesses could borrow easily, and investors seemed happy to chase high growth and all sorts of speculative investments.

Today, we find ourselves in a very different economic environment where sound business fundamentals seemingly matter more than ever. Given our new higher-inflation, higher-interest rate regime, borrowing money is difficult and costly. That’s likely to shrink margins and put pressure on the future earnings of many companies. It’s no surprise, then, that free cash flow (FCF) as a metric of business health is once again coming into focus. We think that’s a good thing. But investors also need to make certain they are using a forward-looking measure of FCF when assessing stocks.

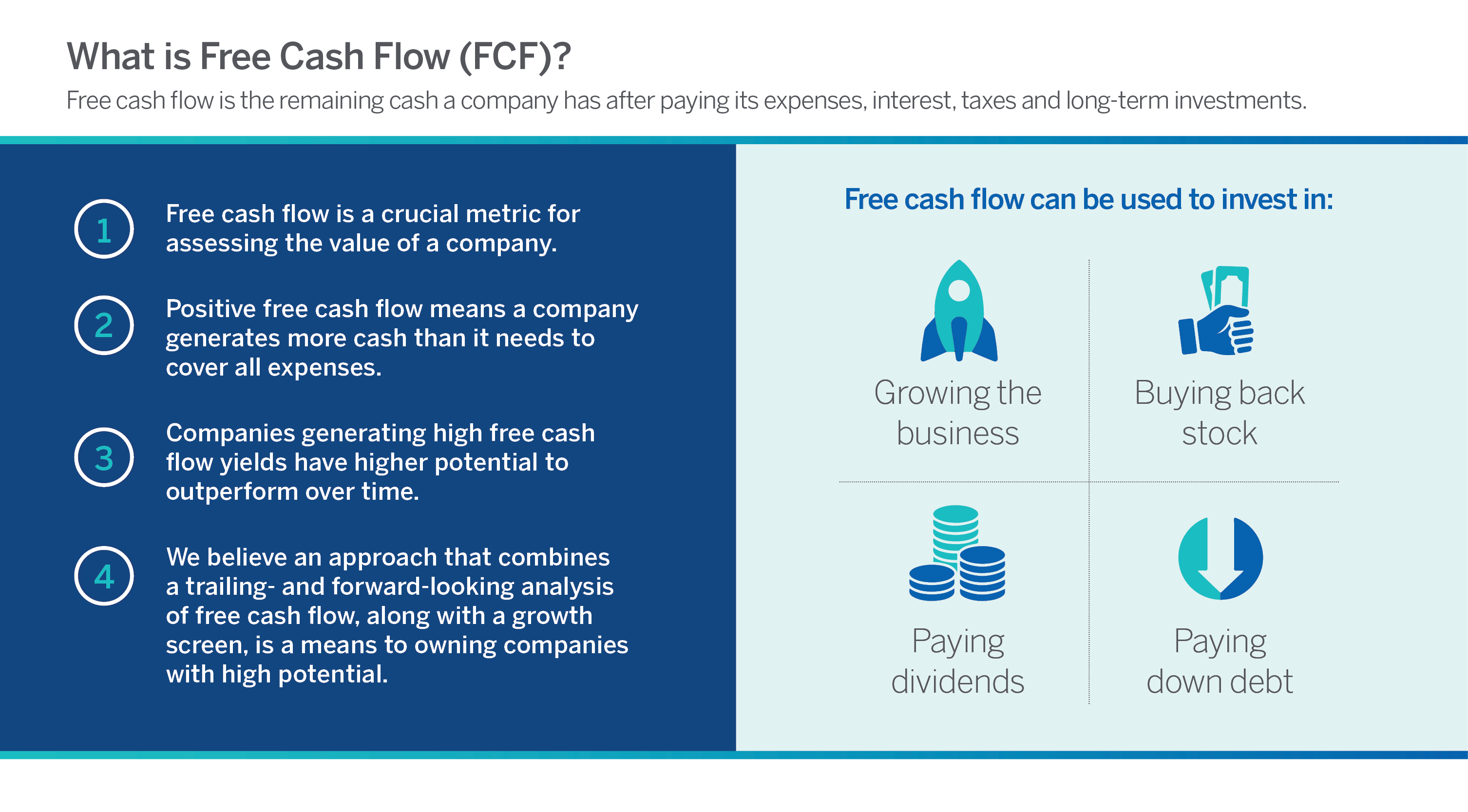

What is Free Cash Flow?

Simply stated, FCF is the amount of cash a company is generating after paying its expenses incurred to continue operations and remain in business. In other words, it provides an important snapshot into a company’s ability to generate excess cash—potentially for reinvestment to grow the business or often to return to shareholders through dividends, buybacks, or other shareholder-friendly activities. Of course, there are various ways to calculate FCF, but in general we believe that it’s a good indicator of a business’ overall financial health and a potential window into future prospects.

There are, of course, limitations with relying on a narrow (historical) view of FCF. After all, company management teams that are too focused on maintaining FCF might possibly forgo an important reinvestment of working capital into an exciting longer-term growth opportunity.

Forward Looking FCF

There is, however, a more nuanced approach to using this powerful metric. Typically, many investment managers rely heavily on trailing measures of FCF. However, the effectiveness of the FCF metric might be enhanced by incorporating a forward-looking measure to provide a better estimate of a company’s expected future results. Taking a combination of trailing FCF and factoring in some forecasted measures of future FCF should reveal a more optimal measure of expected business health. We believe that screening for stocks in this manner is an excellent basis to begin building a portfolio. From here, adding in some filters, such as looking for growth measures, can further narrow the field of companies and, possibly, identify those with better potential.

Importantly, a focus on FCF is, for all practical purposes, a value-oriented strategy in terms of investment style. That might be particularly important to any investors who are either concerned about allocating to aggressive growth styles today, or possibly worried about the risks associated with current stock valuations after the market rebound to date this year.

Whatever happens with the economy and financial markets in the near term, it’s unlikely that we are going back to the uber-accommodative monetary policies of the recent past. The era of cheap capital looks to be over. In this new environment, value stocks—and more importantly those with attractive, forward-looking free cash flow—might be better positioned for the challenges ahead.